Fiscal Sponsorship with Trailhead Institute:

Your Questions Answered

Need a fiscal sponsor? At Trailhead Institute, we deviate from the traditional route most fiscal sponsorship programs take. Our Administrative Partnership Program (APP) provides financial, administrative, and compliance support, allowing community leaders to focus on helping their communities flourish. Here are some of the most common questions potential partners ask us.

Fiscal sponsorship is a partnership where a nonprofit (the fiscal sponsor) provides fiduciary oversight, financial management, and administrative support to help build the capacity of a charitable project. At Trailhead, we consider fiscal sponsorship a mutually beneficial partnership where we can work together to accomplish our missions.

We do all the (boring) background work so you can stay in the community where you are needed most! We offer full financial, grant, and contract oversight, ensure compliance, and lend administrative support.

Fiscal sponsorship is a great option for new or growing projects seeking to raise money before they are recognized as tax-exempt by the IRS. Working with a fiscal sponsor helps projects access funding from private foundations who often can only grant funds to tax-exempt organizations, from government grants that require a 501(c)(3) designation, and from donors who seek to make tax–deductible donations. Charitable organizations that don’t need to form their own nonprofit – or groups that want to reduce administrative burdens – also benefit from fiscal sponsors who support their administrative responsibilities, manage complex compliance requirements, and handle back–office tasks including grant management.

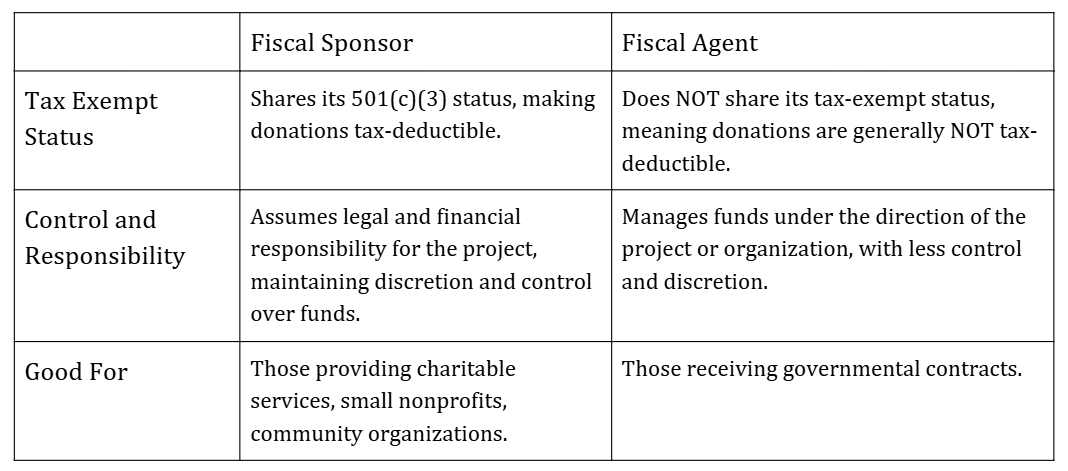

A fiscal sponsor shares its tax-exempt status and assumes responsibility for funds. Fiscal agents provide specific financial or administrative services for a fee on your behalf, but ownership and responsibility of those funds still belong to you. Trailhead can serve as both, depending on the need.

Our APP partner the Colorado Blueprint to End Hunger works towards a Colorado where everyone can access the food they choose, where they want it, and when they need it. Photo Credit: M Ray, Blueprint.

Launching and sustaining a nonprofit takes significant time, resources, and expertise, and many new nonprofits struggle to compete for funding. Fiscal sponsorship allows you to start your work right away, leveraging Trailhead’s relationships with funders and infrastructure to navigate extensive legal and accounting compliance that often takes attention away from your mission. If you decide you want to become your own 501(c)(3) at any point in our partnership, we are here to support that journey.

While Trailhead can bring projects under several different models of fiscal sponsorship, our most common partnerships are under Model A and Model C.

In Model A (Comprehensive Fiscal Sponsorship), your project becomes a direct project under our tax identification number, and we take on full legal and financial responsibility for the project. This model offers extensive support and can be beneficial for individuals, small groups, volunteer-based initiatives, or unincorporated collectives that seek autonomy with limited capacity.

In Model C (Pre-approved Grant Relationship), your project maintains independence as a separate legal entity, like an LLC or 501(c)(3), and is not housed within Trailhead’s legal or HR structure (unlike Model A). In Model C, Trailhead accepts tax-deductible donations and philanthropic funding on behalf of the project and disburses those funds according to the agreement. This model allows the sponsored project to maintain its independence while benefiting from Trailhead’s tax-exempt status.

Not at all! Under Model A, your project would operate under Trailhead’s employer identification number (EIN), allowing us to assume legal and financial responsibility. Under Model C, any funds that we support also operate under our EIN. However, we can create a contract that specifies a mutually agreed upon flow that suits your needs.

Yes! Even established nonprofits benefit from fiscal sponsorship to reduce administrative responsibilities, test new initiatives, or expand capacity.

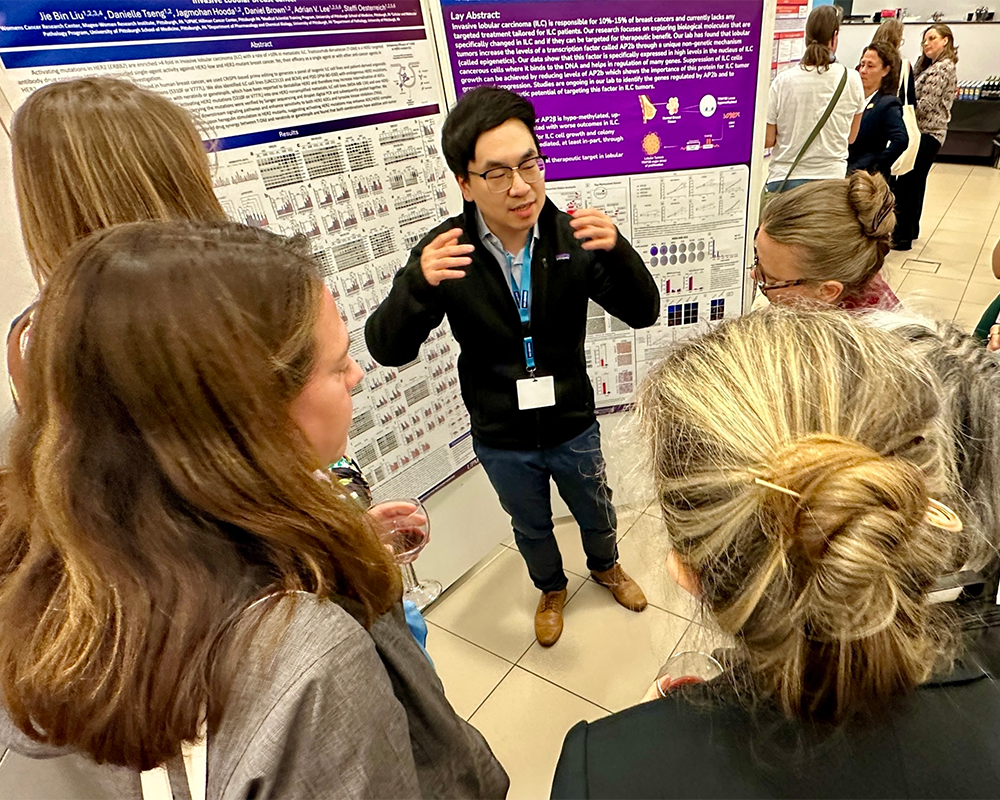

Our APP partner GRASP facilitates discussions between scientists and patients, like this Poster Walkthrough conversation with a poster author. Photo Credit: GRASP.

Our Administrative Partnership Program charges up to the federal de minimis rate on all new money received through your sponsorship. Currently, the rate set by the federal government is 15%.

If a funder requires a percentage less than the de minimis or caps the allowable indirect rate, Trailhead will honor the contract and donate the difference to the project as in-kind services.

Fiscal sponsorship requires significant staff, administrative, legal, and accounting costs. Our fiscal fee covers these expenses, as well as some of Trailhead’s overhead costs. Fiscal fees allow us to offer this valuable program to our communities, and this model ensures that your project doesn’t owe us any money prior to bringing in any funding.

As a public health institute, we advance community-led solutions for better health. We partner with community-based, public health–focused projects that align with our values of Collaboration, Curiosity, Inclusion, Innovation, and Reflection. Our partners have tackled issues like food and housing insecurity, youth wellness, cancer prevention, economic justice, water rights, and many more. We also work with all types of funding sources including individual donations, private grants, local, state, and federal funding, contracts for service, and other fee-for-service opportunities.

Each project is paired with an operations liaison and a finance liaison, who meet with you at least monthly and connect you to the broader Trailhead team. Our relationships with our partners are the best part of our program and we treat our relationships as assets to Trailhead.

Yes, you may have two sponsors if funding and activities remain separate. We can also support transfers from other fiscal sponsors, though some funders may restrict this.

We don’t write grants on your behalf, but we’re happy to be a thought partner, provide edits or feedback, or help develop talking points for program officers to strengthen your proposals.

Yes! We’ll review all project needs during the application process to make sure they align with our mission and capacity.

Future endeavors are not automatically covered under your fiscal sponsorship agreement. New projects and/or ventures require review to ensure they meet charitable purpose requirements. We’re always happy to discuss ideas with you!

We accept cash, checks, in-kind gifts, material goods, and electronic funds through third-party donation platforms.

Our APP partner PNCT is a training program for health/patient navigators, Community Health Workers (CHWs), promotores de salud, care coordinators and their supervisors. Photo Credit: PNCT.

No. Projects are covered under Trailhead’s general liability, Directors and Officers, and cybersecurity policies. If a funder requires additional coverage, that would be the project’s responsibility.

We want you to have as much autonomy as possible in deciding how your community will benefit from funding. You have full autonomy in how funds are used, as long as they follow grant agreements, financial policies, and IRS rules. We’re here to guide you if questions arise.

Trailhead’s Board of Directors is the ultimate legal authority over Trailhead and our fiscally sponsored projects. The Board provides governance and strategic oversight, approving Trailhead’s Employee Handbook, General Policies, and Fiscal Policies, but does not manage day-to-day operations. Projects typically create their own advisory boards for guidance and expertise.

Under Model C, the fiscal sponsor does not employ the project’s staff. You are responsible for hiring, managing, and paying employees (or contractors), and staying compliant with labor laws.

Under Model A, Trailhead serves as the legal employer for the project’s staff and provides HR, payroll, and benefits to the project’s employees. We refer to employees through Model A as Affiliate Staff at Trailhead. Trailhead supports hiring through Model A if budgets allow. Please be aware that the process takes time (3-4 months minimum) and advanced planning with Trailhead’s hiring team.

If you are thinking about hiring employees in the future, your budget must support 12 months of funding for each position and should include an additional 30+% on top of any salaries for the cost of benefits. For example, if you are looking to hire a project manager at $80,000/year, you will need an additional $24,000/year, or a total of $104,000/year of funding to support employment of the manager through Trailhead.

You do. We offer flexible options in our agreements, but our philosophy is that intellectual property stays with the community and founders. We only need the ability to report on it in accordance with our fiduciary responsibilities.

No. Funds are held within Trailhead’s account and tracked in a restricted fund for your exclusive use. This ensures compliance while protecting your resources.

We provide free access to tools like Instrumentl, online donation platforms, and support for community fundraising. While we don’t run events, we can help with logistics and provide guidance.

We never want to be a barrier to the flow of funds from funders to the community. As a part of our fiduciary duties to the public as a 501(c)(3), we retain control over your funds while you have access to our financial portal to pay vendors electronically, make purchases in person or online, and issue payments through weekly check runs. We prioritize quick turnaround and aim to pay most vendors within 5–10 business days.

No, we are not a grantmaking organization. Our role is to provide infrastructure, not direct funding.

How do I apply for fiscal sponsorship?

Start by watching our short pre-screening webinar series below. Then email us at Adminpartner@trailhead.institute with the subject title "It's hAPPening" to set up a meeting. We'll schedule a 1:1 meeting with you. If your project is a good fit, we'll send you a link to our APPlication!